Stock exchanges have long been seen as bastions of capitalism, where profits often take precedence over social or environmental concerns. But what if these very institutions, typically associated with short-term gains and money-hungry investors, could become champions of sustainability and purpose? Our study, published in the Journal of Management Studies, reveals a surprising shift in the role of stock exchanges in tackling grand global challenges.

In a world where climate change, inequality, and social injustice demand urgent solutions, it is easy to assume that progress must come from governments or grassroots movements. Yet, our research suggests that stock exchanges, often viewed skeptically as gatekeepers of profit and greed, are stepping up as orchestrators of change. By adopting a more transparent and purpose-driven approach, stock exchanges are challenging the conventional wisdom that profit and purpose can’t coexist.

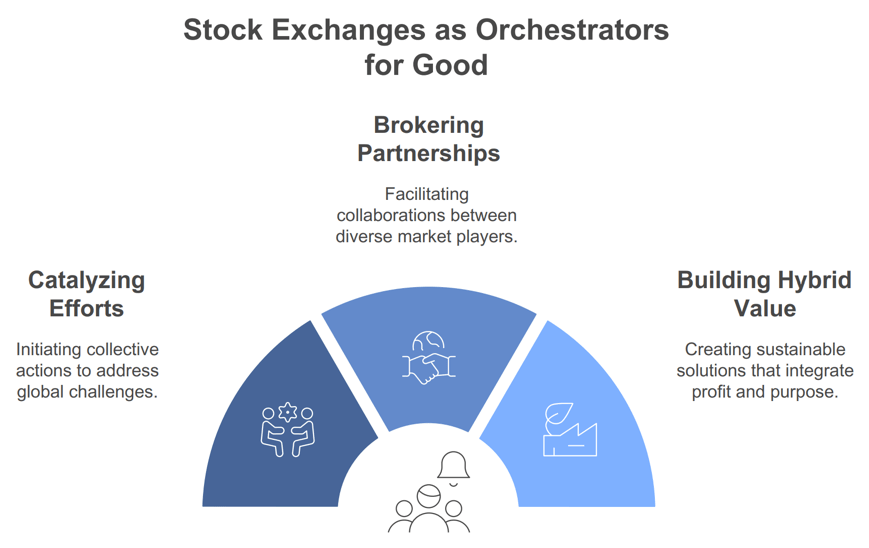

Our study dives into the efforts of three Latin American stock exchanges, identifying a new role of orchestrating collective action for sustainability. Through a process we describe as “hybrid value creation,” these exchanges are not only adapting to the growing demand for sustainable practices—they are actively shaping it. Their strategy follows a three-step path: catalyzing new conversations about sustainability, brokering relationships between diverse market players, and building the necessary infrastructure to support sustainable finance.

Orchestration in Action

But how does this really work? In the early stages, these exchanges leveraged their unique influence as central actors in capital market ecosystems to push for change. Through this unique influence, they are able to create spaces for market participants—companies, investors, and regulators—to discuss the future of sustainable finance. This wasn’t about simply adding a “green” label to existing practices. Instead, they used their unique market position to spark a conversation about why sustainability matters to everyone in the market ecosystem.

The exchanges then moved into a brokering phase, guiding companies through the practicalities of integrating sustainability into their operations. This included helping businesses navigate the complexities of green bonds and sustainability reporting. Far from being passive actors, these exchanges became active brokers, showing companies how to align profit goals with positive social and environmental impact, which often requires “walking the talk” themselves, and learning new practices and processes.

Yet, this journey wasn’t without challenges. In a space where investors typically prioritize short-term returns, embracing a broader definition of value creation can feel like an uphill battle. By framing sustainability as an opportunity rather than a burden, these exchanges shifted the narrative—and in doing so, reshaped the rules of the game.

In the final phase of their approach, the stock exchanges we studied focused on building the structures needed for this new way of doing business. They worked closely with regulators, developed new market infrastructure, and created educational programs to ensure the entire ecosystem could adapt to and embrace these changes. They even tapped into international markets, positioning themselves as leaders in sustainable finance and creating a ripple effect that extends far beyond their borders.

Building a Blueprint for the Future

Our findings challenge the perception that stock exchanges are merely platforms for trading or engines of traditional capitalism. Instead, they show how these institutions can play a critical role in reshaping markets, turning profit-driven environments into spaces where sustainable practices can grow and thrive.

This study offers a provocative reminder that change can come from unexpected places. By embracing their role as orchestrators, stock exchanges are proving that even the most profit-focused institutions can drive meaningful progress. They aren’t abandoning their roots in capitalism; rather, they are redefining what it means to be a market leader in an era where tackling climate change and inequality is more urgent than ever.

For anyone looking to understand how businesses and markets can address the world’s biggest challenges, this study highlights an essential lesson: the solutions may lie in the choices we collectively make – even those made on trading floors – and the often unseen actors orchestrating that change.

0 Comments