Our recent study, published in the Journal of Management Studies, explores how CEOs’ pre-career exposure to religion influences corporate tax avoidance. We found that CEOs who attended religious universities are more likely to pay higher taxes, influenced by values of social responsibility instilled during college. These imprinted values affect corporate decisions, moderated by the current social context. This insight can guide boards in CEO selection to ensure ethical corporate governance and tax practices.

In a world where corporate governance and ethical decision-making are increasingly scrutinized, understanding the factors that shape the values of top executives has never been more critical. In our study, we delve into an intriguing aspect of executive background: the pre-career exposure to religion and its impact on corporate tax avoidance.

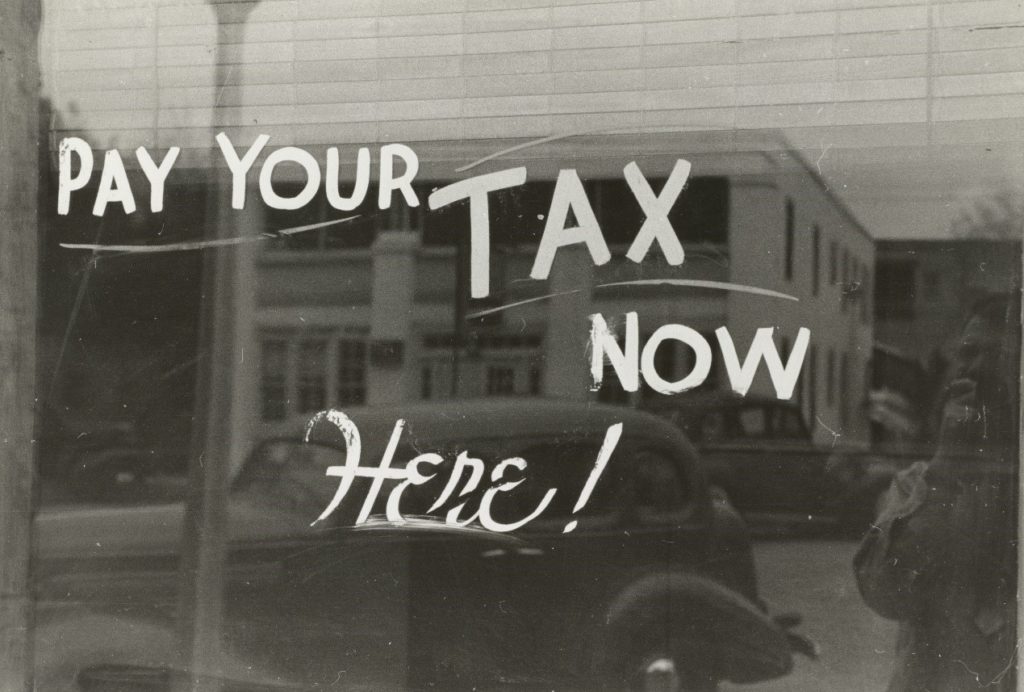

Religion and Corporate Tax Avoidance

Existing academic research and practitioner studies have shown that the religious environment surrounding a firm significantly influences its corporate strategies. However, there is a need to understand how individuals’ religious experiences continue to affect their behavior in the workplace.

This study examines individuals’ exposure to religion during pre-career stages, particularly focusing on their college experiences. During college, individuals develop new cognitive schemas that not only reflect their interpretation of the environment at that time but also shape their enduring values and beliefs.

However, the values imprinted on CEOs may only be activated under specific circumstances. This study focuses on a key corporate practice: tax avoidance. Although legally permissible to some extent, tax avoidance often walks a fine line between aggressive tax planning and unethical behavior. Our study proposes that CEOs who attended religious universities are less likely to engage in such practices.

Empirical Evidence from the US Context

In this study, we collected anecdotal evidence on the influence of attending a religious university and found that these institutions often instill values emphasizing community service and social responsibility. Analyzing a sample of US-listed firms from 2000 to 2019, we further discovered that CEOs with an educational background in religious universities are generally more compliant with tax obligations, paying on average 0.9% more in taxes compared to their counterparts without such exposure.

Our study also examines how the present social context can moderate the relationship between pre-career religious exposure and corporate tax avoidance. We found that political corruption reinforces, while corporate social performance weakens, the influence of these imprinted values. Interestingly, it is the religious atmosphere in the external community, rather than the one shaped by key members within the organization, that affects the impact of CEOs’ pre-career religious exposure.

Key Takeaways

Our findings offer valuable insights for tax practitioners and tax authorities, revealing that CEOs, as key decision-makers within firms, exhibit varying levels of tax morality. Specifically, CEOs who attended religious universities are likely to develop strong values emphasizing social obligations. These values, imprinted during formative years, significantly influence their corporate decisions, including tax practices. Therefore, boards concerned with fulfilling their fiduciary duty should consider whether executives’ educational backgrounds, particularly any affiliation with religious institutions, fit their corporate strategy when selecting the next CEO.

It is also important to recognize that imprinted values are specific types of personal traits that can remain latent until activated by certain situations. The influence of CEOs’ pre-career religious exposure depends on both firm-level and region-level factors. This understanding underscores the complex interplay between individual values and situational contexts in shaping corporate behavior.

In conclusion, our study highlights the lasting impact of pre-career religious experiences on corporate decision-making. By considering these factors, companies can better navigate the ethical complexities of corporate governance and tax practices.

0 Comments