Summary

Impact investing (II) aims to achieve measurable social or environmental impacts alongside financial returns and has been attracting interest in both theory and practice. Our paper, published in the Journal of Management Studies, synthesizes knowledge on II through a systematic review of 104 scholarly articles. We provide a distinct definition of II and show that the raison d’être of II, its measurable societal impact, is not scrutinized in the literature. We propose systems theory as holistic lens for future II research.

We need a thorough understanding of Impact Investing

Societal challenges such as climate change and social inequality require significant financial capital investments. However, many traditional private financing options focus solely on maximizing financial returns, neglecting societal impact. As II aims to fill this gap, we argue that policy-makers need an informed understanding of this concept to devise and implement suitable regulations that align well with the needs of actors in this emerging field. Also, research on II is still in its infancy, needing theoretical foundation to further develop the concept. Our study in JMS provides a comprehensive understanding of II by shedding light on the relationships between different actors, the underlying investment rationale of investors, the role of the institutional environment, and the development of impact measurement practices.

By reviewing 104 scholarly articles we clarify terminologies, identify common topics and findings, highlight gaps, and propose future research avenues. Through our work, we seek to bridge the gap between financial returns and societal impact in investment practices and contribute to the advancement of II as a transformative force in addressing global challenges. Thus, we lay the groundwork for future theorizing and theoretical contributions.

What we know and what we don’t know on Impact Investing

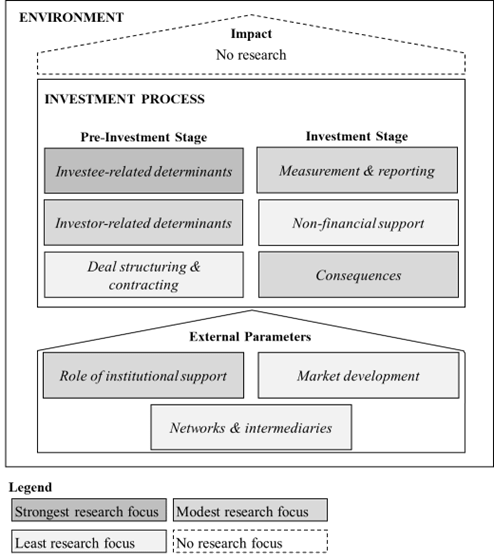

Our analysis provides valuable insights into the current state of scholarly knowledge on II in nine key topics, which we organized into the pre-investment stage, the investment stage, and external parameters as illustrated in the (shortened) Figure.

Investee-related determinants received the most attention in our sample. This area has provided solid knowledge, highlighting similarities between financial criteria in II and commercial investments. However, the remaining eight topics have seen less concentrated research efforts or a too narrow research focus, resulting in significant knowledge gaps and limited generalizability. Especially the perspectives of investees are largely lacking and we know little about the investment stage of II.

Methodologically, qualitative-empirical research is dominant in almost all topics, providing in-depth insights but leaving room for quantitative studies to confirm and generalize. Geographically, the research primarily focuses on developed countries, despite the growing importance of II in developing and emerging economies.

Additionally, the existing research has only scarcely touched topics such as the role of institutional support, deal structuring and contracting, non-financial support, and intraorganizational tensions. Only a minority of articles reference theories, mainly from organizational studies and economics and finance. No theory covers the entire spectrum of research identified for the field of II. Most surprisingly, the actual societal impact of II—thus its raison d’être—has entirely been neglected in literature.

How to move Impact Investing research forward

In our paper, we develop a definition of II as investments conducted by professional investors in companies, organizations, and funds with the intention to create a measurable social and/or environmental impact, alongside a financial return paid by the investee. However, the literature lacks solid insights into the potential or actual societal impact of II while focusing primarily on individual-level outcome measurements. We also note that if II shifts social and environmental responsibilities from governments to private investors, it can potentially amplify existing inequalities and power structures. Therefore, it is vital to scrutinize both positive and negative societal impacts of II for better transparency, accountability, and effectiveness. Furthermore, while management research is urged to contribute to solving societal challenges, it often maintains a narrow business-centric focus. We affirm that understanding the societal impact of II requires holistic approaches.

Thus, we propose the application of systems theory to achieve such a holistic perspective. Systems theory emphasizes an organization’s embeddedness within its broader environment. This approach helps to understand how collaboration between investors and investees and syndication processes can change the system’s constitution and impact. We suggest that while II seeks to mitigate societal challenges arising from current system structures, it’s worth exploring whether this same system can provide solutions or if a transition towards other systems is necessary.

Additionally, we suggest various methodological approaches to measure the true impact of II. Longitudinal and large-scale qualitative studies, including ethnographical research, can illuminate the influence of II decisions on investee choices and eventual impact. Quantitative-empirical methods, like randomized field experiments inspired by Nobel prize winning work of Banerjee, Duflo, and Kremer—though quite challenging—are necessary to identify causal relationships between investor behavior and outcomes, comparing different investment strategies. Alternatively, life cycle analysis provides a socio-technical approach for assessing the impact of products or organizations but it needs methodological advancements to be able to holistically capture social and positive impacts of II.

Insights beyond academia

Policymakers can utilize our findings to develop robust policies that promote II and improve monitoring of social and environmental outcomes. Informed decisions based on our insights can create an enabling environment for impactful investments that drives societal change.

For investors, our research underlines the importance of shifting focus from mere financial returns to the true social and environmental impact of investments. Adopting a holistic perspective enables investors to improve decision-making and align with sustainability goals and facilitates a comprehensive evaluation of investments’ real impact. Moreover, our research encourages investors to consider the needs of investees, especially regarding impact measurement and non-financial support.

Lastly, our findings provide valuable insights for investees to enhance their impact measurement practices. Our research highlights the potential hurdles that can impede the assessment of social and environmental outcomes, equipping social enterprises with the knowledge to refine their strategies and align objectives with measurable impact. This understanding empowers investees to effectively communicate their impact to stakeholders and attract potential impact investors, furthering the cause of II.

In essence, our research offers practical insights that can guide the II ecosystem towards more conscientious investments that drive sustainable, societal change.

0 Comments