Most investment firms today engage in sustainable investing, which are investment strategies that consider environmental and social factors. Estimates of the market share of sustainable investing reach as high as 36% of all assets under management. The sharp rise of sustainable investing in recent years has sparked a controversy regarding its impact. While the sustainable investment industry calls on shareholders to “refocus their efforts on where they can generate positive environmental and social outcomes,” critics dismiss sustainable investing as a “dangerous placebo,” refuting that sustainable investing—through its influence on companies—can have a positive impact on the environment and society.

In a literature review published in the Journal of Management Studies, we help advance these discussions by offering a broader understanding of how sustainable investing can create a positive impact on the environment and society. Many researchers and practitioners assume that sustainable shareholders can create impact through either portfolio screening or shareholder engagement. Portfolio screening involves the reallocation of capital from non-sustainable to sustainable companies, while shareholder engagement entails direct interactions with companies. Yet, this misses that some shareholders at the periphery of the financial system—such as religious shareholders or specialized impact funds—regularly move beyond portfolio screening and shareholder engagement. These peripheral shareholders, for example, raise work “at industry levels to set standards and norms.”

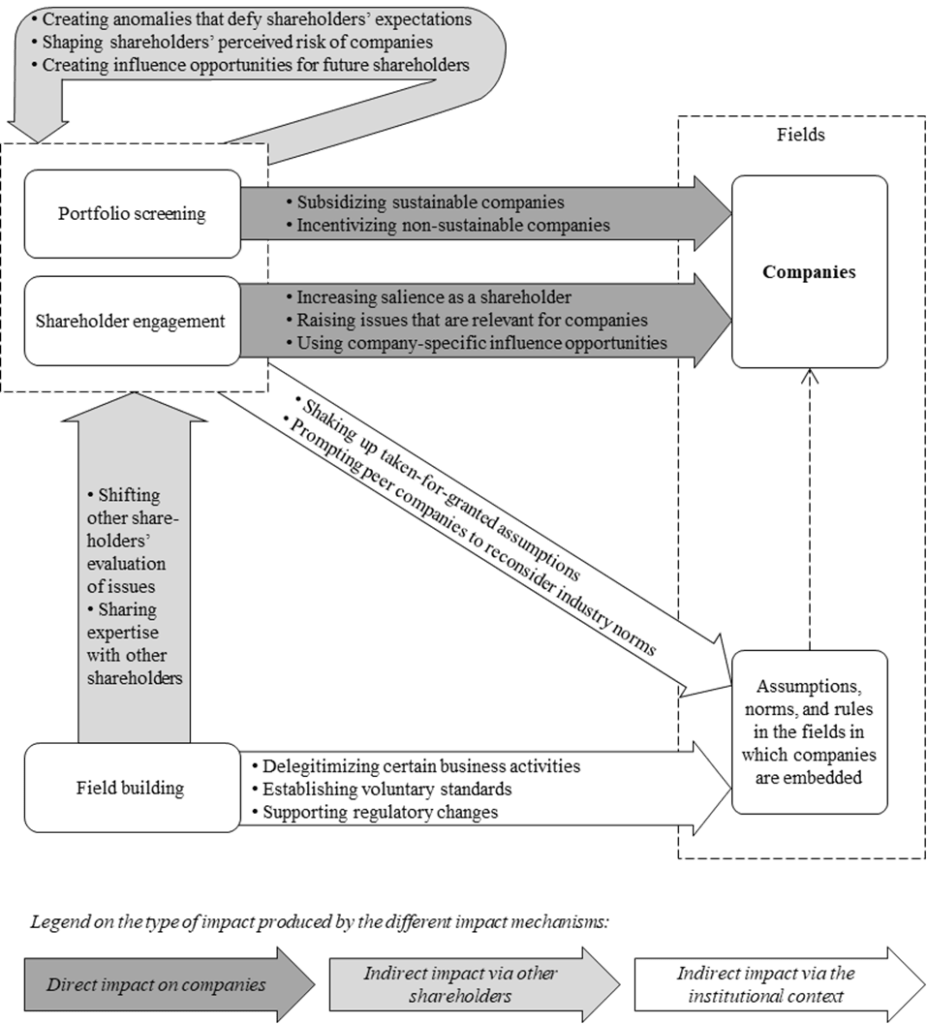

In our literature review, we conceptualize such activities as field building. Field building means that shareholders try to make companies more sustainable by influencing the fields in which these companies are embedded. Field building works because companies are always embedded in fields. Fields are similar to industries, but broader. Fields include not only different stakeholders, but also the assumptions, norms and rules that emerge through the interactions in a field and that guide behavior within a field. By engaging in field building, shareholders shape these fields, thereby exerting indirect influence on companies.

Based on this broadened conception of how sustainable investing can create impact, we conducted a multidisciplinary literature review covering research in management, finance, sociology, and ethics/sustainability. By screening almost 4’000 papers, we identified 69 papers that conceptually or empirically examined the impact of sustainable investing. Analyzing these 69 papers led us to identify 15 impact mechanisms through which sustainable investing can induce companies to become more sustainable. The following figure shows our main model from the literature review:

We hope that our model broadens the understanding of how sustainable investing creates impact in both research and practice. For researchers, our literature review outlines new directions for research on how sustainable shareholders use field building to create impact. And for practitioners, for whom we have also written a practitioner version of the paper in the Harvard Business Review, we hope the evidence we gather on the impact of field building helps them use a broader set of tools to generate a positive impact on the environment and society.

0 Comments