Entrepreneurial resource acquisition

Entrepreneurship, the process by which “opportunities to bring into existence ‘future’ goods and services are discovered, created, and exploited”, has long been recognized as a critical driver of economic efficiency and growth, innovation in the market, new job opportunities, and modern prosperity. But entrepreneurs usually face a scarcity of valuable resources, which are usually in the possession of various external stakeholders and protected by non-entrepreneurial resource trustees. Therefore, the probability of entrepreneurs developing and prospering their new ventures often hinges on their ability to obtain support from external stakeholders. Compared with their western counterparts, Chinese entrepreneurs in particular are confronted by this obstacle because of their notorious lack of sociopolitical legitimacy, i.e., a new venture’s perceived congruence with the normative expectations of the institutional system such as regulations, rules and standards created by governments and intermediary agencies. Therefore, an important issue in entrepreneurship in China is securing approval from external stakeholders.

Informational cues to win over external stakeholders

As there is usually information asymmetry between external stakeholders and entrepreneurs. Entrepreneurs can rely on certain informational cues to win over external stakeholders, such as their social connections, past performance, prior start-up experience, and business/technical expertise to signal their underlying quality. But the conviction carried to stakeholders by these cues may be at least partially determined by how much interaction takes place between the stakeholders and entrepreneurs. Naturally, the more opportunities an entrepreneur has to talk to external stakeholders, the more likely it is that the entrepreneur’s informational cues will be received and interpreted favorably by the external stakeholders. For this reason, the amount of attention entrepreneurs allocate to external activities affects the likelihood of being able to access resources controlled by external stakeholders.

How Buddhist belief influences the process

Our study, published in the Journal of Management Studies, analyzes a nation-wide survey data of 941 Chinese entrepreneurs with information on their Buddhist belief. Buddhism is the most dominant religion in China. We postulate that because of the Buddhist doctrine of “no-self” (Pali: anatta), Chinese Buddhist entrepreneurs tend to encourage their employees to control more internal activities, allowing the entrepreneur to allocate more attention to external activities. In China, due to the lack of government background and performance record, private entrepreneurs are especially subject to the scrutiny of their sociopolitical legitimacy. As entrepreneurs devote greater attention to interacting with external stakeholders, the latter’s concern about the former’s sociopolitical legitimacy can be relieved. As a result, Chinese Buddhist entrepreneurs have greater access to external resources. This indirect influence of entrepreneurs’ Buddhist beliefs on their improved access to external resources by allocating attention to external activities is stronger when sociopolitical legitimacy matters more.

Implications for entrepreneurs

Our findings are useful for entrepreneurs to review the process by which they allocate their attention. Entrepreneurs’ attention is scarce. So, it is important for them to allocate this valuable resource to those areas that are critical to the success of their new ventures. Entrepreneurs should realize that their allocation of attention may not be guided completely by technical or economic factors, but that their personal preferences and beliefs sometimes come into play. Furthermore, entrepreneurs should also be more aware of their own religious background when gaining sociopolitical legitimacy in the eyes of key external stakeholders. It is usually difficult to assess an entrepreneur’s underlying quality directly. External stakeholders can rely on how much interaction takes place between them and the entrepreneurs to infer the underlying quality of new ventures. In addition to their demographic, technical, and educational background, entrepreneurs’ religious background may also provide alternative cues to external stakeholders and relieve their concern for entrepreneurs’ sociopolitical legitimacy.

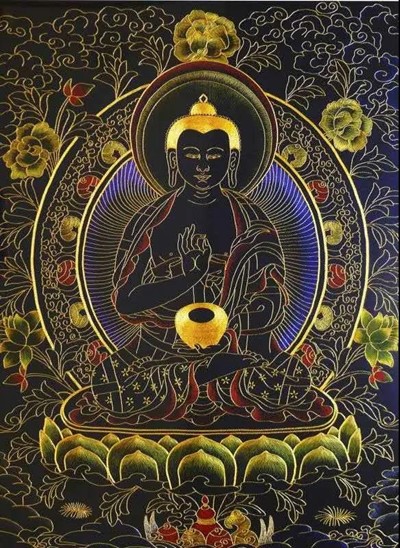

Photo by Huazhen Yang’s embroidery work

0 Comments